CPG Pricing Strategies: Navigating Inflation, Tariffs, and Market Volatility in Foodservice

Setting a pricing strategy has never been simple, but in today’s environment of unpredictable tariffs, global realignments, and persistent inflation, it has become an orchestration of elements for CPG manufacturers serving the foodservice industry. Effective pricing today is less about reacting to cost increases and more about harmonization: aligning costs, market dynamics, and customer value into a coherent, profitable strategy.

Account managers, sales directors, finance leaders, and CFOs are all grappling with the same dilemma: Do you raise prices and risk losing customers, or absorb costs and erode margins?

From supply chain bottlenecks to inflationary pressures, the challenge is clear: keep restaurants, schools, and hospitality venues supplied while safeguarding profitability.

The Reality of Inflation and Tariffs

Month after month, inflation remains elevated, eroding purchasing power and reshaping consumer behavior. From September 2024 to September 2025, the all-items Consumer Price Index (CPI-U) increased 2.9% in the U.S. Food prices rose 3.2% in the 12 months ending August 2025, with overall food costs up 26.61% from 2020, a $5.32 difference in value for an equivalent purchase (BLS).

For restaurants, where profit margins often hover between 3–5%, even modest cost increases can be devastating. Tariffs exacerbate the challenge, driving up raw material costs and creating ripple effects across supply chains.

Some manufacturers treat inflation as a temporary disruption, drawing down cash reserves to “ride out the storm.” But this approach is short-sighted. Consider this scenario:

- Net income: 15% of revenue

- Cost of goods sold (COGS): 50% of revenue

- Inflation impact: A 10% rise in COGS (due to raw material, labor, and transport costs)

On $1M in monthly revenue, net income falls from $150,000 to $100,000—a $50,000 hit per month. Ignoring pricing action in this environment can be catastrophic.

Moving Beyond the P&L: Why CPG Pricing Strategies Must Evolve

While P&L statements highlight cost pressures, they often obscure underlying dynamics like inventory valuation and market shifts. CPG manufacturers must rethink how they account for and respond to inflationary pressures:

- Inventory timing matters: Costs for inventory produced in the last quarter may differ significantly from those for current production. Treating all inventory costs as uniform can lead to flawed pricing decisions.

- Balance sheet perspective: Recognize inventory as an asset and price based on true replacement costs, not historical averages.

- Market context: Pricing decisions must consider consumer demand, competitor behavior, and brand positioning—not just internal cost pressures.

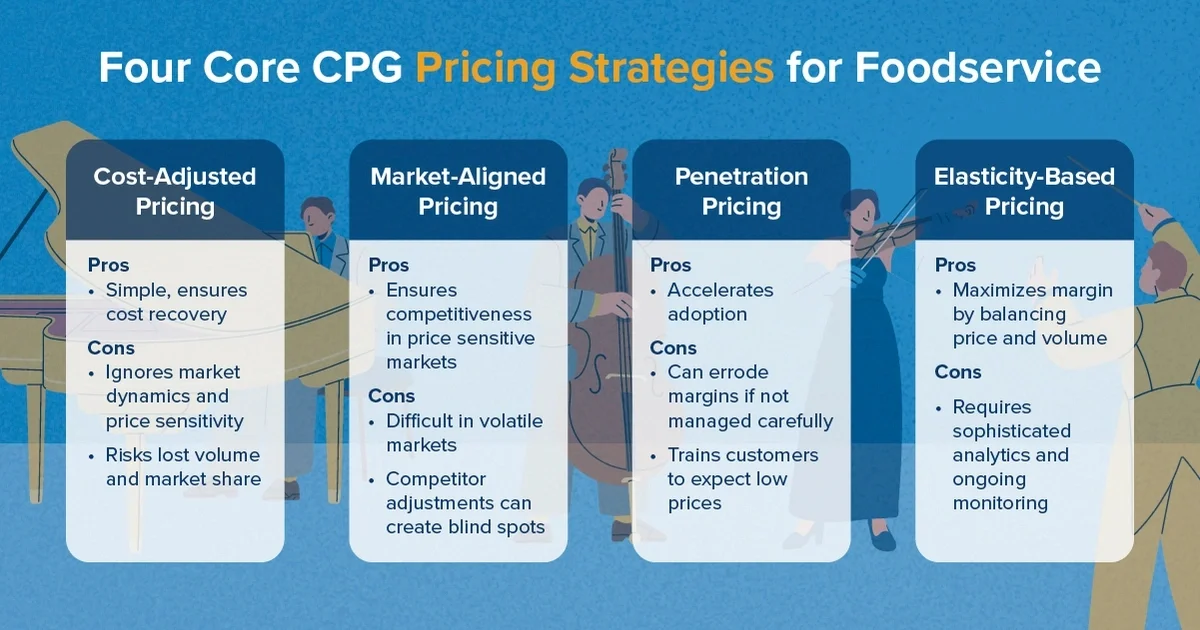

Four Core CPG Pricing Strategies for Foodservice

84% of restaurant operators report higher food costs as their top challenge in 2025. (National Restaurant Association). To thrive in today’s volatile environment and support customers, CPG manufacturers must select and refine a pricing strategy suited to their position and goals:

1. Cost-Adjusted (Cost-Plus) Pricing

Increase prices in direct proportion to cost increases (e.g., costs rise 10%, prices rise 10%).

- Pros: Simple to calculate, ensures cost recovery to protect margins.

- Cons: Ignores market dynamics and price sensitivity, risking lost volume and market share. Cost may not correlate to customer value leading to under-price (revenue reduction) or over-price (sales reduction).

Insight: Cost-plus pricing can be effective in the short term for essential or highly differentiated products, however without ongoing cost control measures and a clear value story, customers may perceive price hikes as unjustified, which can open the door to competitors.

2. Market-Aligned (Competitive) Pricing

Set prices relative to competitors’ benchmarks.

- Pros: Ensures competitiveness in price-sensitive markets by reflecting what customers are willing to pay while allowing for adjustments based on demand.

- Cons: Difficult to effectively monitor in volatile markets, where timing differences in competitor adjustments can create blind spots.

Insight: Competitive pricing is most effective when combined with advanced analytics tools. Real-time monitoring of competitors’ moves enables faster reaction, but success ultimately depends on knowing where you can lead rather than always following.

3. Penetration Pricing

Launch new products at low introductory prices to capture market share quickly.

- Pros: Rapid market entry accelerating adoption and potentially stimulating demand.

- Cons: Low initial pricing can lead to reduced profit margins and may affect customer perception of quality.

Insight: Penetration pricing can be a powerful tactic in foodservice launches, but it requires a clear exit strategy. Without a planned path to sustainable, profitable pricing, manufacturers risk training customers to expect “cheap” indefinitely.

4. Elasticity-Based (Value-Based) Pricing

Use data and analytics to understand price elasticity of demand and optimize prices for optimal profitability.

- Pros: Maximizes margin by balancing price and volume.

- Cons: Requires sophisticated analytics and ongoing monitoring. Across the consumer products industry, only about one in four manufacturers (25-30%) have implemented advanced analytics in pricing.

Insight: As consumer budgets tighten, elasticity-based pricing becomes increasingly critical. Restaurants have less room to absorb costs, making precise price optimization a competitive advantage.

Each CPG pricing strategy plays a role in the composition of variables: cost-plus provides the steady rhythm of cost recovery, market-aligned pricing adjusts to competitors’ tempo, penetration pricing builds momentum, and elasticity-based pricing ensures you never miss a beat.

The right pricing approach depends on your market position, cost structure, and competitive landscape. While cost-based methods may help weather immediate shocks, long-term success comes from aligning price with value and market realities. Manufacturers that integrate multiple approaches—anchored in data—will be best positioned to maintain profitability and customer trust.

Key Considerations for Effective CPG Pricing Strategies

In today’s complex environment, simply choosing a pricing model isn’t enough, and executing on tempo is everything. CPG manufacturers must consider multiple variables simultaneously: shifting consumer preferences, volatile input costs, competitive pressures, and long-term brand positioning. Successful companies are those that view pricing not as a one-time decision but as an ongoing, data-driven discipline.

Here are critical factors that strengthen CPG pricing strategies in foodservice:

- Data-Driven Insights: Leverage analytics to understand consumer behavior, demand fluctuations, and willingness to pay.

- Cost Management: Dissect cost structures beyond tariff percentages to find areas for efficiency.

- Brand Positioning: Ensure pricing accurately reflects brand value—premium, mid-tier, or value.

- Tiered Product Architecture: Offer multiple product formats or pack sizes to serve varying budgets.

- Promotional Flexibility: Use targeted discounts and offers to drive volume without undermining long-term pricing power.

- Competitive Monitoring: Track competitor pricing and adjust proactively.

- Profitability Focus: Shift from volume-driven strategies to margin-optimized ones.

- Technology & Automation: Invest in tools for real-time price monitoring and dynamic adjustments.

Pricing is no longer just a finance function—it’s a strategic capability that integrates marketing, operations, and sales. Those who invest in robust analytics, cross-functional collaboration, and proactive planning will gain a lasting competitive edge. In a foodservice market defined by volatility, this is what separates reactive survivors from proactive leaders.

Mitigating Risk in CPG Pricing Strategies

To reduce exposure and build resilience:

- Set clear pricing objectives aligned with strategic priorities and risk tolerance.

- Conduct granular cost analyses to identify pressure points and leverage opportunities.

- Model price sensitivity across products, segments, and geographies.

- Develop contingency plans with scenario modeling to anticipate market shifts.

Finally, consider price pack architecture, offering variations in size, format, or bundle, to meet evolving customer needs and protect margins without across-the-board price hikes.

In a volatile market, successful CPG pricing strategy is an act of orchestration, bringing together the right instruments at the right time to deliver sustained profitability. Those who blend data, market insight, and strategic agility with price confidently—protecting profitability while sustaining partnerships across the foodservice supply chain—will receive a standing ovation.

Get the latest news, updates, and exclusive insights from Vistex delivered straight to your inbox. Don’t miss out—opt in now and be the first to know!