Wrangling A Foodservice/B2B Solution Into A Retail TPM Solution

Is it possible to run retail promotion management and foodservice contract management in one place?

Anyone who has worked with or for a consumer products manufacturer can tell you: retail and foodservice have unique terminology and processes related to planning, execution, settlement, analysis and reporting.

2 primary routes to market

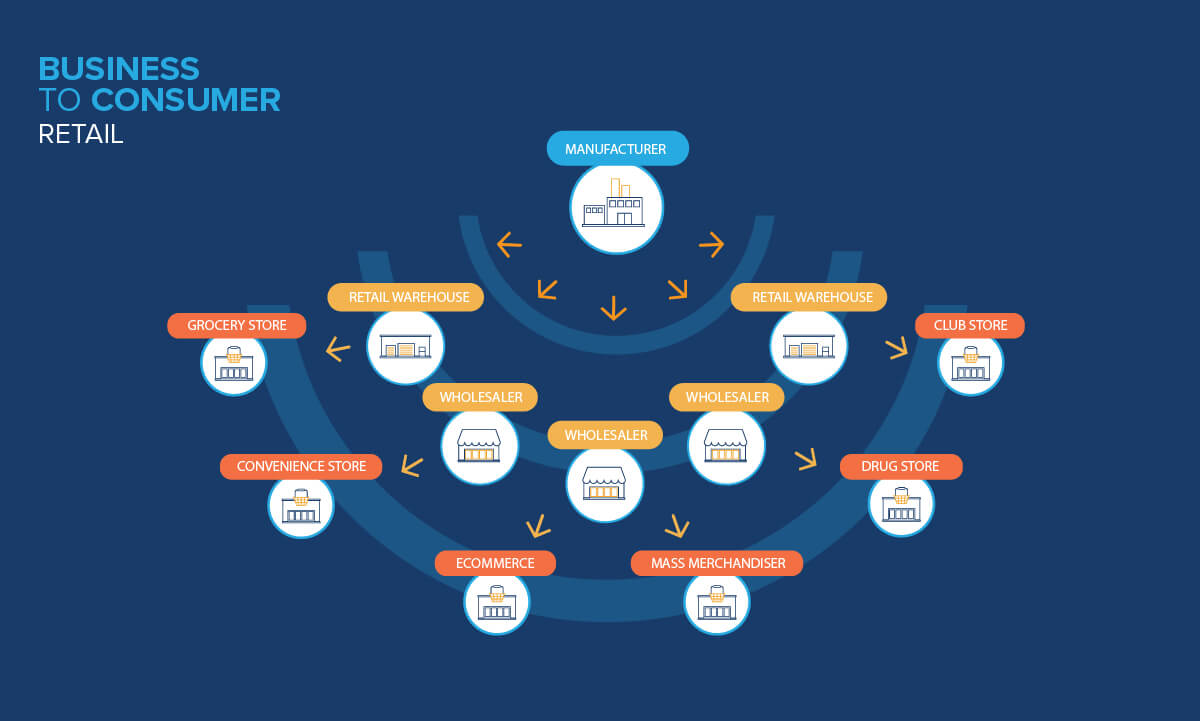

- Retail: when product is sold through a direct or indirect distribution network and ultimately via a physical or online outlet where consumers purchase the item to be consumed at a later time.

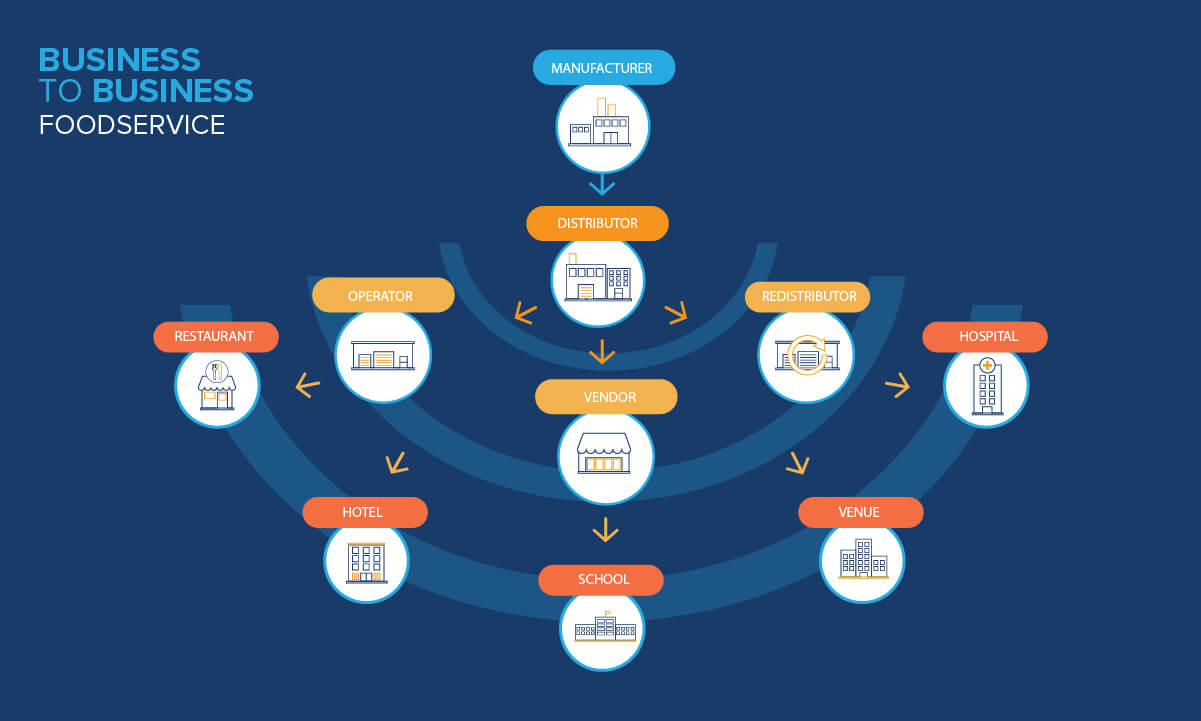

- Foodservice/B2B: when product is sold entirely through an indirect distribution network and then to the consumer with the expectation that the product will be consumed immediately.

A consumer products manufacturer primarily selling into the foodservice route-to-market typically has a smaller retail market business component. Historically, a manufacturer with a large foodservice route-to-market may not have a significant retail presence. However, over time these manufacturers have either developed a retail product or acquired retail brands that are not tied to a foodservice route-to-market.

As a CP Manufacturer with a primary business in a retail route-to-market with a small foodservice/B2B business, managed offline, you focus on trade planning at the point of sale (POS). This could be either brick & mortar or ecommerce. You are primarily investing in merchandising conditions to expand category share. Your trade promotion management solution is typically architected using hierarchies and is configured for retail processes and KPI’s. Terminology includes promotion, merchandising conditions, deductions, and POS deals in your plans.

You’re committed to an annual plan and budget containing fixed funding, variable rates, or a combination of both. For an account manager, this is a “a fist full of dollars” with a sales objective for your customer plan. Your job is to manage a large amount of overlapping short-term promotions at a hierarchical level for your customer plan which contains multiple merchandising conditions.

The good, the bad and the ugly

- “The Good” are product hierarchies utilized within the promotions to provide account managers with the ability and advantage of planning at multiple levels, eliminating repetitive data entry.

- “The Bad” are retail applications that utilize hierarchical structures to do reporting and analysis at any level and they must perform a “back-end” job to allocate ALL data and store it at the lowest levels.

- “The Ugly” are the more complex and layered hierarchies of 60 to 70 customer plans and 2,500 to 3,000 SKU’s coinciding with a growing database. This back-end job can be an arduous task.

Because it’s not the same difference

When the same CP Manufacturer has grown their foodservice/B2B to a point where it’s the same size as the retail route-to-market, it becomes a challenge to manage offline processes in a spreadsheet. These need to be automated primarily because not only does the manufacturer not sell retail products through the foodservice channel but they also have separate SKU’s which are typically larger in size.

Foodservice/B2B selling focuses on contract pricing, sales incentive administration, bids and managing volume through a 3-tier supply chain system. Planning is typically a minimal task with a focus on contract management at the lowest level of the customer product hierarchies. The foodservice/B2B route-to-market will have significantly more points of distribution with the contracts/programs created at the SKU level and not the promoted pricing group (PPG) or higher. Foodservice manufacturers use terms such as rebate programs, deviated pricing, and claims which are for the most part, a foreign language on the retail side.

Why shoehorn when there is a better way

The CP manufacturer typically attempts to manage the foodservice business through their retail application, but because the configuration is for retail, the field descriptions are different, for example, volume forecasts require a base/lift entry, and hierarchies cannot be utilized due the SKU level contract entry. The application does not provide the claims validation capability, with no reconciliation traceability to the accrual to settlement. As a result, data entry becomes increasingly complex. Data coming out of the system is poor and now there are frustrated account managers and brokers who do not want to work in the system.

This can be a system issue if the application is an “out-of-the-box” solution, or the application has been strictly configured for a retail route-to-market. Out-of-the-box providers will claim their application can manage both channels, but don’t be roped in. Be sure to check the age of the release and who is utilizing the application.

Get the latest news, updates, and exclusive insights from Vistex delivered straight to your inbox. Don’t miss out—opt in now and be the first to know!