Price Pack Architecture Strategies to Weather Any Storm

CP Price Pack Architecture (PPA) Strategies Remain Key to Success in Uncertain Economic Times

Foodservice Caught in a Crosswind

The foodservice industry is seeing several changes due to multiple economic and political factors, increasing uncertainty and sharpening a focus on value among consumers and distributors alike. With the U.S. Consumer Price Index showing a 2.7% YoY increase [U.S. Department of Labor, June 2025 report], wariness about price increases is foremost on minds. However, consumer products companies may hold an edge.

Many suppliers and operators have delayed passing down higher costs. However, this lag will not last long, and they will be forced to start passing the cost on, bringing the foodservice industry in line with inflated costs and supply chain disruptions.

Before this realignment begins in earnest, foodservice operators may enjoy a narrow window of opportunity, especially with patrons who view dining out as a comfort, necessary convenience, or support for their overall emotional well-being. Though disposable income may be shrinking for many, those who are dining out favor operators offering great taste (69%), quality product (56%), and portion size (41%), suggests a 2025 food and beverage trend report (Datassentials).

Charting a Course with Shrinkflation: Is It the Right Direction for Foodservice?

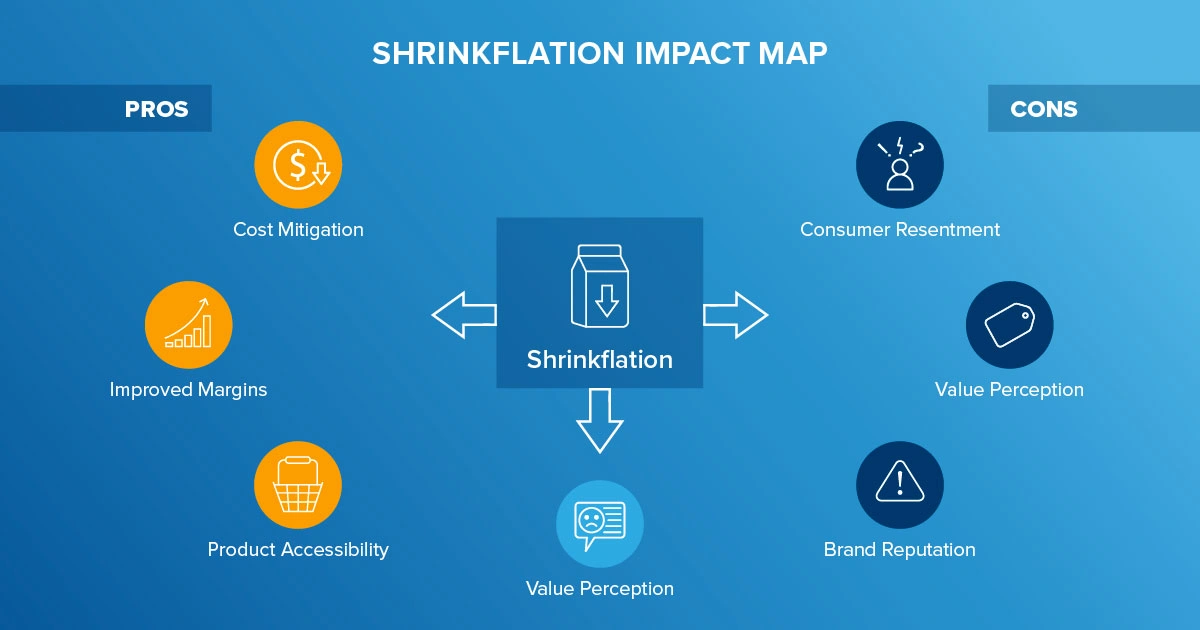

A derivative of inflation, “shrinkflation” allows restaurants to institute a reduction in portion size as one tactic to manage costs and preserve margins. This practice gained some traction during the pandemic as a temporary cost-recovery tactic due to supply chain shortages, but shrinkflation risks disfavor among watchful consumers critical of corporate profiteering and sensitive to perceived deception.

What’s the bright side of shrinkflation in turbulent financial times? Whether the demand to dine out is driven by treat culture mentality or other consumer trends, both patrons and restaurants can benefit from a shrinkflation pricing strategy. For the restaurant proprietor, smaller portions may lead to patrons adding on an appetizer or dessert, typically at higher margins than entrees. For the diner, smaller portions may represent a more healthful or balanced choice than “super-sized” options while satisfying an emotional or social need.

How Can CP Manufacturers Find a Tailwind?

On the flip side, shrinkflation in foodservice challenges consumer products manufacturers seeking effective pricing strategies. As restaurants increase prices or reduce portion sizes, there is a need among food and beverage companies to understand the price at which they will remain competitive.

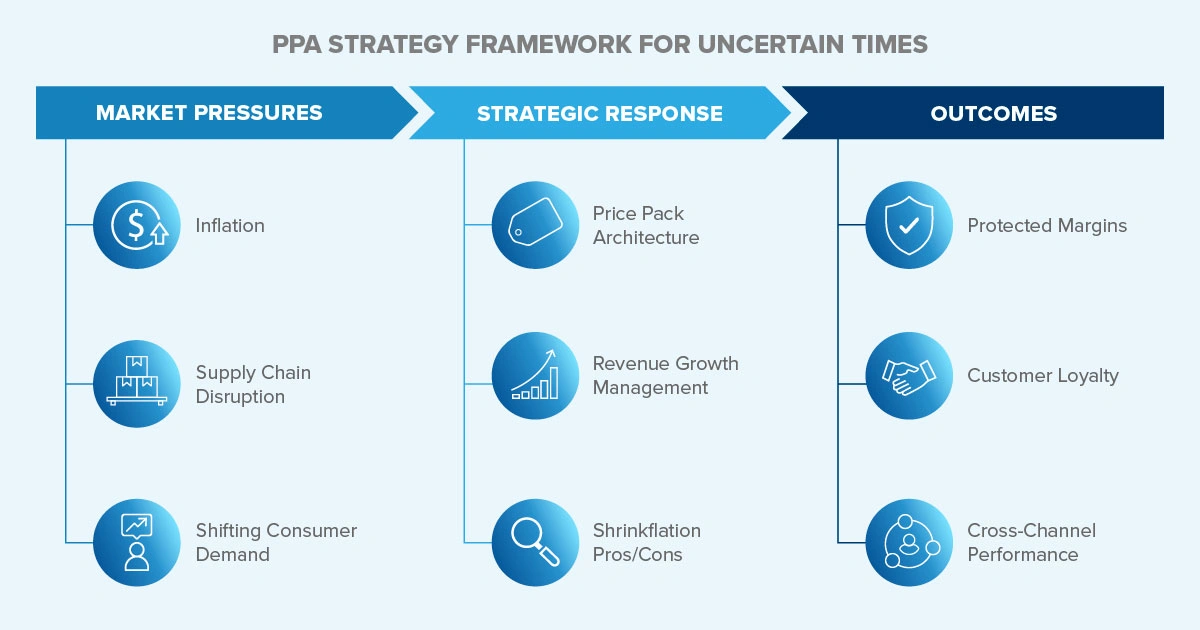

This is when revenue growth management (RGM) frameworks and strategic CP pricing decisions provide essential guidance necessary to navigate rising costs, economic uncertainty, consumer price sensitivity, and pervasive value consciousness.

With an estimated three-quarters of 2024’s sales growth in the consumer products industry stemming from price increases rather than volume gains (Bain & Company), there’s little room for further price increases, suggesting that it won’t be a breeze to realize volume gains in the foreseeable future before sales growth improves.

How to Improve Consumer Products Pricing Strategies Faced with Headwinds

To remain competitive and profitable in periods of high inflation and recession, manufacturers need sound, agile pricing strategies to successfully face pressures surrounding raw material and production costs, rapidly changing consumer behavior, and foodservice operator requirements tied to cost management and value. Data-driven insights help both manufacturers and operators make informed decisions.

Tips to consider:

- Let the past inform the future

- There’s something to learn from failures as well as successes. Evaluate all prior strategies, from cost-plus pricing to tiered and dynamic pricing. What worked, when, and under what conditions? Which ideas held promise but missed the mark in execution? There may be an opportunity to mine when performing this type of analysis.

- Employ optimal operational and incentive tactics to soften the impact of any single price increase and monitor all costs to identify areas where margins might be strained. Communicate price pack architecture changes and regularly with customers to cultivate a valued partnership and encourage their investment in your solutions.

- One size doesn’t fit all

- Sweeping price increases may help temporarily counteract the cost of inflation, raw materials, labor shortages, and disrupted supply chains, but come at what cost to customer loyalty? Instead, manufacturers should evaluate price pack architecture strategies based on varying product mix, distribution channels, and factoring in causal influences, seasonality, consumer behavior, promotion and program options in addition to taking a surgical approach to price adjustment. Again, communication and transparency will be key to supporting these actions thoughtfully.

- While maximizing profit is likely a key objective of any CP manufacturer, other short-term goals shouldn’t be overlooked. Turning smaller profits per item and offloading excess stock, for example, can also impact pricing strategy selection, ultimately impacting bottom line, customer perception, and competitive position.

It's easy to see how the implementation of strategic RGM, including pricing management, trade promotion, and technology help consumer products manufacturers improve margin, enhance trade effectiveness, and elevate performance across channels – even when business environments are rapidly changing.

Set sail for Part 2 of this blog series to navigate deeper into consumer products pricing strategies and their impact on the foodservice industry.

Get the latest news, updates, and exclusive insights from Vistex delivered straight to your inbox. Don’t miss out—opt in now and be the first to know!