A License To Deal

Navigating deal risk and making licensing a decisive competitive advantage

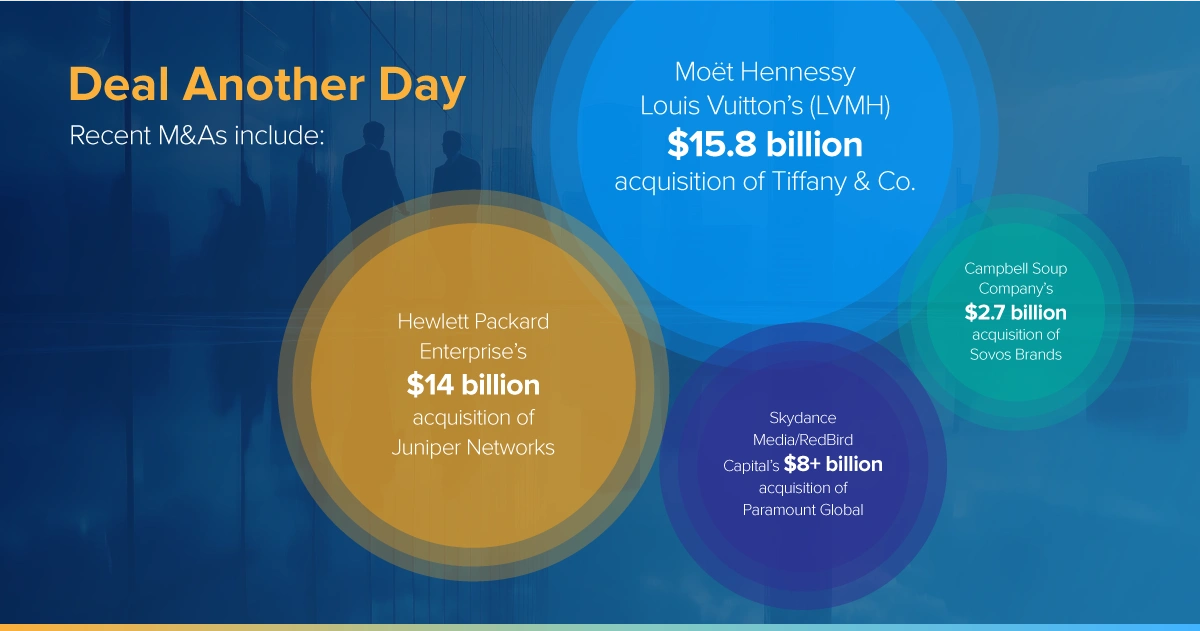

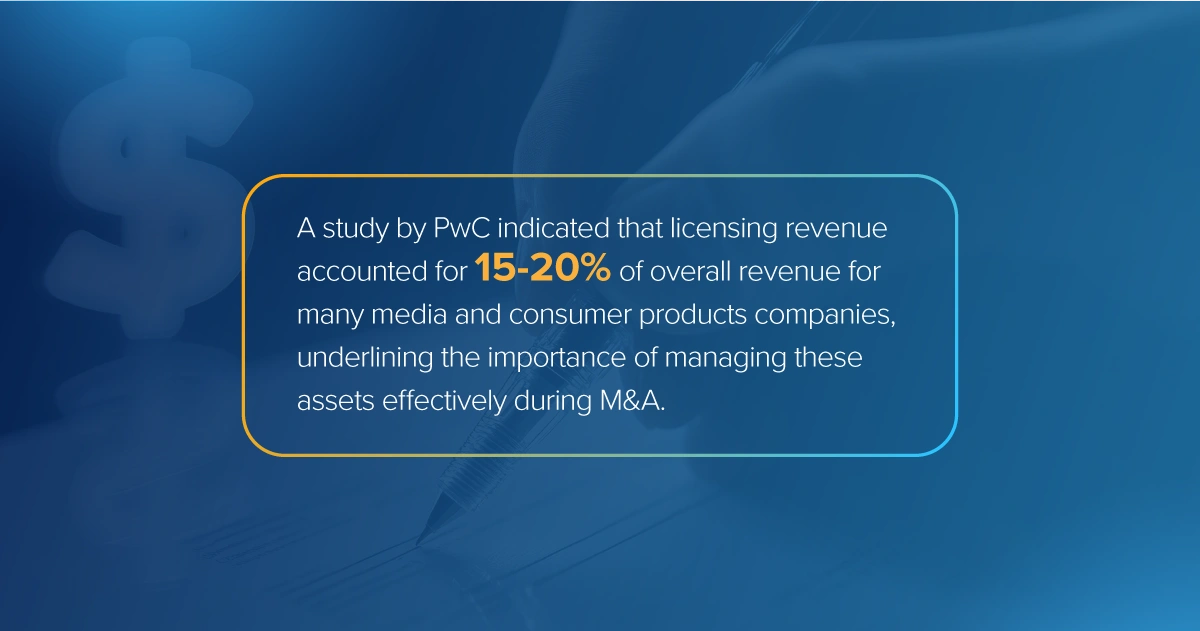

Mergers and acquisitions (M&A) have become a prevalent strategy for growth, market expansion and consolidation in industries like media and entertainment, consumer products, high tech and fashion. While M&A teams focus on financials and negotiations, they often underestimate the licensing challenges that await post-merger.

Picture a $2 billion merger unraveling because product portfolios may ultimately conflict legally or strategically once the intellectual property (IP) in those portfolios is included. As M&A deals grow increasingly complex, these scenarios aren't just cautionary tales — they're costly realities. Licensing complications can be a hidden landmine in the M&A landscape, capable of turning promising deals into expensive lessons in due diligence.

For your deals only: Hidden hurdles of license management

Licensing involves managing IP rights, including patents, trademarks, copyrights and brand names, often governed by complex agreements with different terms, territorial limitations and royalty structure. These agreements can create significant challenges during an M&A transaction:

- Managing IP rights

Merging entities often have overlapping IP rights and inconsistent licensing terms across regions and products, which can create conflicts if not carefully mapped and managed.

- Determining royalty structures

Differences in royalty arrangements, such as mismatched rates, complex revenue-splitting and varying financial tracking systems, can complicate the integration process. - Ensuring compliance

M&A requires navigating diverse contractual obligations, including conflicting quality standards and sales requirements, overlapping territorial restrictions, and differing reporting schedules across countries. - Managing partner relationships

Uncertainty among licensees or agents about the future of their agreements can strain relationships, leading to non-compliance or loss of revenue.

- Managing sub-ledger accounting and financials

Tight integration between accounting systems is essential to track sub-ledger accounting in royalty payments and licensing finances to prevent discrepancies in valuation and operational efficiency.

The deal is not enough: Mastering licensing integration

I believe a strategic approach to licensing integration is needed to mitigate risks and maximize the value of a merger. By following best practices and strategies, you can convert potential challenges into a competitive advantage.

- Conduct a comprehensive IP audit

Before finalizing the merger, conduct a thorough audit to identify conflicting or overlapping agreements, territorial restrictions and royalty structures. - Standardize licensing agreements

Standardizing licensing agreements across your organization as part of the integration process ensures consistency in terms, conditions, royalty structures and product approvals. - Leverage technology for seamless integration

Use data-driven solutions to integrate disparate licensing systems across merging entities. These solutions offer flexibility, scalability and real-time collaboration, ensuring smooth post-merger licensing activities. - Monitor and optimize licensing performance

After the merger, continuously monitor the performance of licensing agreements using data-driven insights to identify opportunities for renegotiation, optimization or consolidation.

- Manage partner relationships

Open communication and integrated systems are crucial to retaining valuable partnerships during and after the merger, ensuring continued compliance and revenue.

Deals are forever: 5 benefits of data-driven solutions

As the complexity of M&A grows, so does the need for efficient licensing management. From my perspective, licensors, licensees, agents and other stakeholders increasingly turn to data-driven solutions to address the complexities of managing licensing agreements, IP rights, royalties and financial reporting. These solutions are critical in streamlining operations, mitigating risks and ensuring seamless integration during the merger transition. Data-driven solutions provide 5 key benefits:

- Streamlined integration of licensing data

Consolidating real-time information on IP rights, royalty rates, payments and compliance helps create a clear overview of the merged identity’s licensing landscape, reducing manual errors. - Automation of licensing processes

Automating repetitive tasks like royalty calculation, reporting and compliance tracking frees up resources, allowing your teams to focus on negotiating new licensing agreements and optimizing IP portfolios. - Real-time financial visibility

Enhanced visibility into royalty income, product approvals and IP-related expenses aids in forecasting revenue and identifying potential risks or opportunities in licensing operations. - Risk mitigation and compliance

Automation tools help ensure compliance with legal and financial standards by streamlining contract management and risk monitoring. - Centralized reporting and analytics

Centralized reporting allows decision-makers to analyze royalty data, product approvals and licensing performance across the organization, enabling better decision-making and agreement optimization for maximum profitability.

Quantum of success

The stakes have never been higher in M&A licensing integration. A better approach is needed as deals grow more complex and IP portfolios become more valuable. The most successful organizations recognize that licensing isn't merely a post-merger checkbox but a strategic cornerstone that can make or break a deal’s ultimate value.

I’m confident that moving forward requires harnessing the power of modern licensing platforms, embracing data-driven decision-making, and building a proactive licensing strategy into your M&A playbook. If you can master this critical capability, you won’t just avoid costly pitfalls — you’ll discover the hidden value your competitors miss, elevating licensing from a deal risk to a decisive competitive advantage. In today’s landscape of mega-mergers and rapid consolidation, that’s not just smart business — it’s business survival.

Get the latest news, updates, and exclusive insights from Vistex delivered straight to your inbox. Don’t miss out—opt in now and be the first to know!