Glocalization is the critical blind spot for pharma and medical device companies

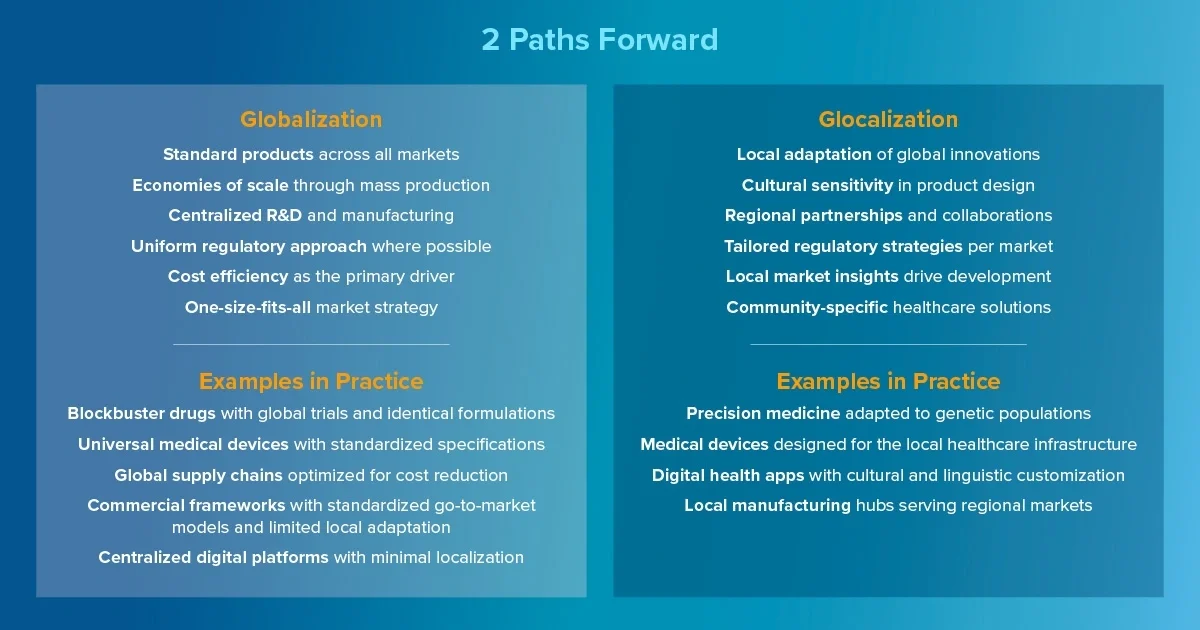

At a recent pharmaceutical industry roundtable, I watched executives grapple with a fundamental tension: how to maintain global efficiency while meeting increasing local demands. This efficiency, built on decades of supply chain optimization, centralized R&D operations and standardizing manufacturing processes to drive down costs, suddenly felt fragile. The conversation revealed a critical truth. The future of life sciences isn’t about choosing between globalization and localization. It’s about mastering glocalization: the strategic fusion of global scale with local market relevance.

How glocalization transforms pharma and medical device strategy and operations

The pharmaceutical and medical device industries face an inflection point that demands more than tactical adjustments. Recent disruptions have exposed the fragility of purely globalized supply chains while revealing the limitations of completely localized approaches. Successful life sciences companies are discovering that glocalization isn’t just a buzzword — it’s a strategic imperative that reshapes how we create value across diverse markets.

The numbers tell the story. The U.S. imposed a blanket tariff on almost all imported goods in 2025, with a staggering tariff specifically targeting Chinese pharmaceutical ingredients. Medical devices from Mexico and Canada now face tariffs. These aren’t policy footnotes; they're seismic shifts that upended cost calculations overnight and forced immediate strategic recalibration.

Europe responded with initiatives like the Critical Medicines Act, designed to boost local production capabilities. Russia declared that 50% of its medicines must be produced domestically, inspiring similar mandates in emerging markets such as South Africa and India. These policy shifts create both challenges and opportunities that require sophisticated revenue management strategies and tools to navigate effectively.

The strategic reality behind market disruption

When tariffs were imposed, many manufacturers launched reactionary responses. Boston Scientific anticipated an extra €190 million in costs from new tariffs on medical devices imported from Mexico. Belgian pharma exports, worth €69.35 billion annually — 25% of which is destined for the U.S. — suddenly faced uncertainty as companies considered shifting production away from established European hubs.

Within this disruption lies a strategic opportunity. This represents more than defensive positioning; it’s strategic repositioning that requires sophisticated pricing and contract management to optimize returns across multiple jurisdictions.

Through my work with life sciences manufacturers, I’ve observed that companies succeeding in this environment leverage integrated commercial platforms like ours that provide real-time visibility into pricing impacts across global markets while maintaining compliance with local regulations.

Democratizing opportunity across market players

Glocalization’s most compelling aspect is how it levels the playing field. While multinationals leverage resources to invest in local infrastructure, small and medium enterprises (SMEs) find themselves positioned advantageously through government procurement preferences and manufacturing incentives.

I’ve witnessed mid-sized diagnostics companies localizing their supply chains within Europe, not just to avoid tariffs, but also to meet stringent data privacy requirements, thereby winning contracts previously beyond their reach. Success in these scenarios requires the ability to manage complex contract terms and rebate structures across multiple regulatory environments simultaneously — capabilities that integrated platforms like Vistex enable for companies navigating this complexity.

Contract manufacturing and development organizations (CMO/CDMO) are experiencing unprecedented growth as companies seek flexible, localized production capabilities without massive capital investments. These partnerships demand sophisticated revenue recognition and accrual management across diverse contractual arrangements.

Building sustainable competitive advantage

The most successful glocalization strategies I’ve encountered combine global expertise with genuine local market understanding. Companies must customize not just products but entire commercial approaches for specific regulatory environments, reimbursement systems and healthcare infrastructures.

This extends beyond product specifications to encompass pricing strategies, distribution networks and stakeholder engagement approaches. Success requires real-time visibility into how local market dynamics affect global profitability, something that becomes possible only with integrated commercial operations platforms.

Small pharma companies in emerging economies partner with global giants through technology-transfer agreements, eventually evolving into regional champions. These complex partnerships require sophisticated contract management and revenue allocation capabilities to ensure mutual benefit and regulatory compliance.

The foundation reality check

I’m genuinely excited about glocalization’s potential, but it’s worth acknowledging the foundational requirements. Glocalization amplifies existing capabilities — both strengths and weaknesses. If your company has fragmented commercial systems or inconsistent pricing strategies, you will find these challenges magnified across multiple markets.

Successful companies establish integrated commercial operations and clean data governance before expanding glocalized strategies. The platform becomes the foundation that enables strategic acceleration, not an afterthought to complex market expansion.

The winning formula combines global expertise and innovation platforms with local needs adaptation, regulatory requirements and supply chain resilience. This creates sustainable competitive advantages that neither pure globalization nor complete localization can match.

What glocalization success looks like for your life sciences company

When I reflect on these market shifts, the disruptions and the strategic responses I’ve observed, I feel both optimism and urgency. For companies of all sizes, glocalization isn’t just a strategic pivot; it’s a test of organizational adaptability. Will established pharma companies embrace the complexity of local market requirements while maintaining global efficiency? Will rising SMEs leverage new partnerships and incentives to build sustainable competitive advantages?

With the right strategic approach, glocalization creates sustainable value for manufacturers while improving healthcare outcomes worldwide.

If this challenge resonates with you, let’s explore how glocalization impacts your pricing and revenue management in life sciences. Join my upcoming webinar where I’ll share practical implementation strategies and discuss how integrated commercial platforms can help you navigate this evolving landscape with confidence.

Get the latest news, updates, and exclusive insights from Vistex delivered straight to your inbox. Don’t miss out—opt in now and be the first to know!