Why pricing power equals pricing freedom

Hey manufacturers, what happens when you change your prices? Do your end customers benefit from price cuts, or does that cut get gobbled up by the supply chain? What did you intend to happen? When you raise prices, do distributors and retailers pass that increase along to the end consumer or just absorb it? Are you concerned about effects on consumer demand more than channel cooperation? Knowing the answer to these questions helps you understand just how much pricing power you have.

What is Pricing Power?

Pricing power is the ability to affect the shelf price of a product by manipulating your own price in the supply chain channel. Let’s say a manufacturer decides to charge $1.00 more. If that increase ripples all the way through the supply chain and the customer ends up paying the extra dollar, the manufacturer has high pricing power.

Now suppose a manufacturer wants to increase market share and drops their price by $1.00. Will the customer pay less? If the distributor does not cut their price and instead pockets that money, the manufacturer is not affecting the price paid by the end customer. This means the manufacturer has low pricing power.

As a manufacturer, it’s important to understand and measure how much pricing power you have. If your pricing power is high, you can adjust your prices to control consumer demand without the cooperation of the channel. You can sell the same quantities at a higher price to make more money. Or, you can sell higher quantities at a lower price to increase your market share. High pricing power translates into pricing freedom.

Let’s take a look at some examples:

High Pricing Power

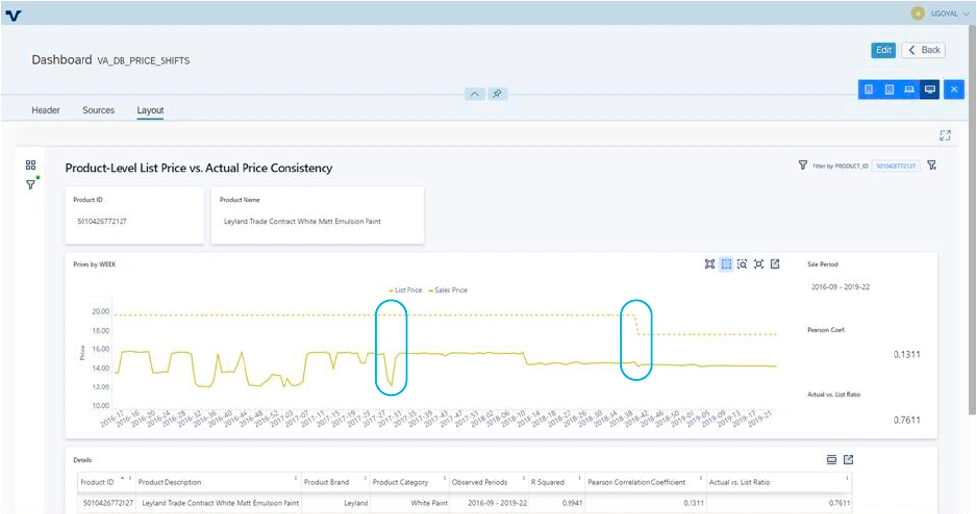

Here we can see strong pricing power. When the manufacturer raises the list price (dotted line) in week 26 of 2018, and again in week 14 of 2019, the shelf price (solid line) also increases. Even if the shelf price is not increasing by the same amount as the list price, there is a strong correlation between the two and very little delay in response. Sometimes you might see a delayed change in the shelf price (perhaps 1-3 weeks) after the manufacturer changes price. This delay depends on the supply chain speed—both in terms of communication of price changes, reaction time of channel partners, and inventory turn-over or “product velocity.”

Low Pricing Power

In this second example, the manufacturer has very little pricing power for the selected product. As the manufacturer changes the list price in week 38 of 2018, the shelf price does not move in a relative fashion. Because the shelf price stayed consistent after the list price change, the gap between these two prices narrowed. This means the supply chain (the distributor and/or retailer) pocketed the savings and did not pass the price reduction on to the end-customer.

The opposite could also happen: the supply chain could “eat” some or all of the manufacturer’s price increases to shield the end-customer from a price increase. While this is good for maintaining consumer demand for this manufacturer’s products, it can disenfranchise channel partners who might decide another manufacturer with better margins can replace your product on-shelf.

Also interesting in the illustration above is the on-shelf price variation seen throughout 2016 as well as week 28 of 2017. These changes in shelf price occur without any change in the manufacturer’s list price. There are two probable explanations for this. First, it could have been the result of promotions supported by the manufacturer through rebates or market development funds (promotional payments to the channel partners). If the manufacturer commonly has promotional programs beyond price discounts reflected in these graphs, then the manufacturer should look at their net sales price for partners rather than the list price when comparing to end-customer shelf price to determine pricing power and channel response. Second, the channel partners might be running their own promotions to the detriment of their own margins in an effort to create demand. (A quick look at channel inventory trends would reveal whether it’s low demand or too much inventory.) In this case, it is likely to be unsustainable for partners to do this without manufacturer support, and the manufacturer could be in jeopardy of losing the channel partner. This could be a leading indicator of impending partner churn, but that’s a topic for a whole new blog!

Get the latest news, updates, and exclusive insights from Vistex delivered straight to your inbox. Don’t miss out—opt in now and be the first to know!