How to bridge the multi-platform media revenue gap and put an end to fragmented royalties

According to PwC, media companies distribute content across an average of 7.2 platforms. Imagine you’re a farmer cultivating 7 fields, each with unique soil conditions, irrigation needs and harvesting schedules. You’re working harder than ever, your crops are thriving and people are enjoying your produce far and wide.

The only problem? You have no idea how much money you're making. Each field uses a different payment system. Some report earnings monthly, others quarterly. Some use pounds as a measurement, others use bushels. When you audit these reports, you discover significant discrepancies.

Replace those fields with digital media platforms, and you’ve entered today’s media company reality, where content reaches more people than ever while creators have never been more financially blind.

You could be deciding what shows to make, what stories to tell and what creative voices to amplify based on flawed, incomplete financial information.

Beyond revenue leakage, you are faced with hidden costs when you don’t have visibility into financials across platforms, compromising forecasts and planning. Without clear insights, you struggle to strategically time content releases and optimize distribution windows for maximum revenue impact.

Channel chaos

Media companies have always dealt with complex revenue streams. Twenty years ago, you consumed media through cable TV, movie theaters, DVDs, radio and print magazines — 5-6 channels, tops.

Today, many streaming services, podcasts, subscription services and ad supported tiers exist. Each platform has its own proprietary language for reporting performance and revenue. It's like having financial statements in 7 different languages, none translating perfectly.

The explosion of FAST channels and niche streaming platforms has complicated revenue tracking in ways most media executives aren't prepared for. Systems in place aren’t geared toward cohesively tracking this information, since many were developed years ago under different market circumstances.

The crisis extends beyond finance. According to SAG-AFTRA, 84% of talent representatives request platform-specific performance data. When your favorite actor, director or producer negotiates their next deal, they ask questions about their content’s performance that many media companies can’t answer accurately.

When you can’t get a full picture from your financials across platforms, you make investment decisions based on incomplete data. You might double down on content that seems successful on one platform while missing that it’s underperforming everywhere else. Or you might cancel the next breakout hit because its success is fragmented across platforms in a way your systems can’t capture.

From data silos to media solutions

Leading media organizations are implementing specific technological approaches to bridge data silos between legacy financial systems and modern distribution platforms. The industry is leaning towards flexible, rule-based centralized systems that are designed for future scaling as the landscape evolves.

If you’re overwhelmed by multi-platform financial integration complexity, the practical first step is conducting an honest assessment of whether your business can change existing processes to better adapt. Most businesses cite this desire yet continue with existing methods due to legacy system limitations or “because that’s the way we’ve always done it.”

5 moves that matter

Thriving media companies have recognized that this is a strategic opportunity, not an accounting problem. Start implementing these 5 critical practices today:

- Creating cross-functional governance teams

Finance, rights management and technology leadership working together, not in silos, to achieve ROI faster. - Taking a phased implementation approach

Start with your highest-revenue platforms, leading to a significantly higher user adoption than trying to fix everything at once. - Establishing robust data governance with standardized definitions across platforms

Organizations doing this see faster time-to-value on their investments and access to analytics. - Investing in change management

Allocate 15% of implementation budgets to this function. - Creating continuous improvement programs

Adapt to evolving platform ecosystems that can generate more value in years ahead.

From hindsight to foresight

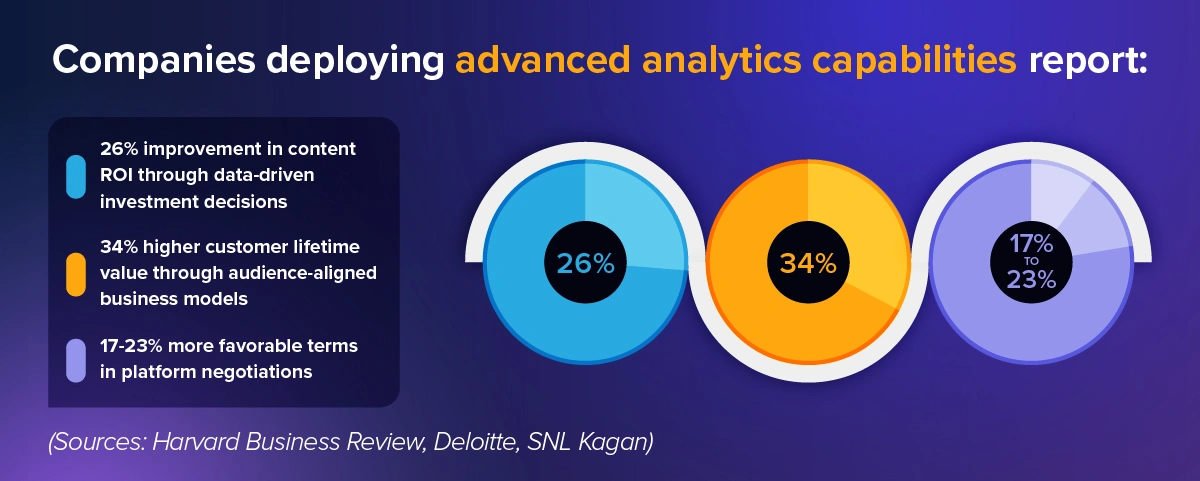

Advanced analytics and AI are transforming revenue management from a backward-looking accounting function to a forward-looking strategic advantage. AI/advanced analytics help with forecasts and projections by considering marketing factors outside the business itself, such as localized performance and sentiment.

Protecting every streaming dollar

Automated rights management plays a crucial role in preventing revenue leakage across an increasingly fragmented distribution ecosystem. A centralized rights management solution enables 360 visibility across various revenue streams in real-time. This is a key departure from the typical evolution of siloed systems designed to address specific pain points at different times, often without assessing how those systems might work together.

Mind the vision gap

The most brilliant creative vision in the world is worthless if it can't be sustainably funded. When you allow this financial blindness to persist, you’re not just hurting balance sheets, you’re potentially silencing essential stories.

Imagine a mid-sized content producer who implemented a unified financial system across more than a dozen distribution platforms and recovered over $4 million in previously unreported revenue in less than a year. Those millions could fund new projects, support creative talent and tell stories that might never be told otherwise.

The final financial frontier

Looking ahead, I believe platform revenue models will continue to evolve, so you must prepare now to maintain your competitive edge.

Change in this industry is constant, and there are systems available that can address multiple aspects of the business within the same solution. This addresses the pain point of incomplete reporting and the ability to properly position for the larger marketplace, rather than just focusing on departmental opportunities.

The platform paradox presents your greatest challenge and your most incredible opportunity. As distribution options multiply, financial visibility becomes exponentially more difficult, yet increasingly valuable.

The media organizations that turn today’s fragmented financial data into tomorrow’s unified intelligence will capture missing revenue and the strategic high ground in an increasingly competitive landscape.

More than better accounting, this is about creating a sustainable future for storytelling itself. Your content deserves to be creatively successful and financially transparent.

The technology to bridge this gap exists today. The only remaining question is whether you’ll be a leader in this revenue reckoning or whether you’ll be playing catch-up in its wake.

For more information on winning the day with media revenue management, read our blog “Revenue Revolution In The Digital Age.”

Learn more about the media platform paradox.

Get the latest news, updates, and exclusive insights from Vistex delivered straight to your inbox. Don’t miss out—opt in now and be the first to know!