What does the future of grocery retail technology look like?

Can technology reshape how we interact with our customers, vendors and internal stakeholders? The short answer is yes; retailers can capture the power of transformative technology to achieve their key business objectives. This is why I want to discuss 3 important findings from the recently published 2023 Supermarket Technology Review by Supermarket News Intelligence and share our insights on how supermarket chains can optimize their tech investment for profitable results.

Key Finding 1: It’s time to explore

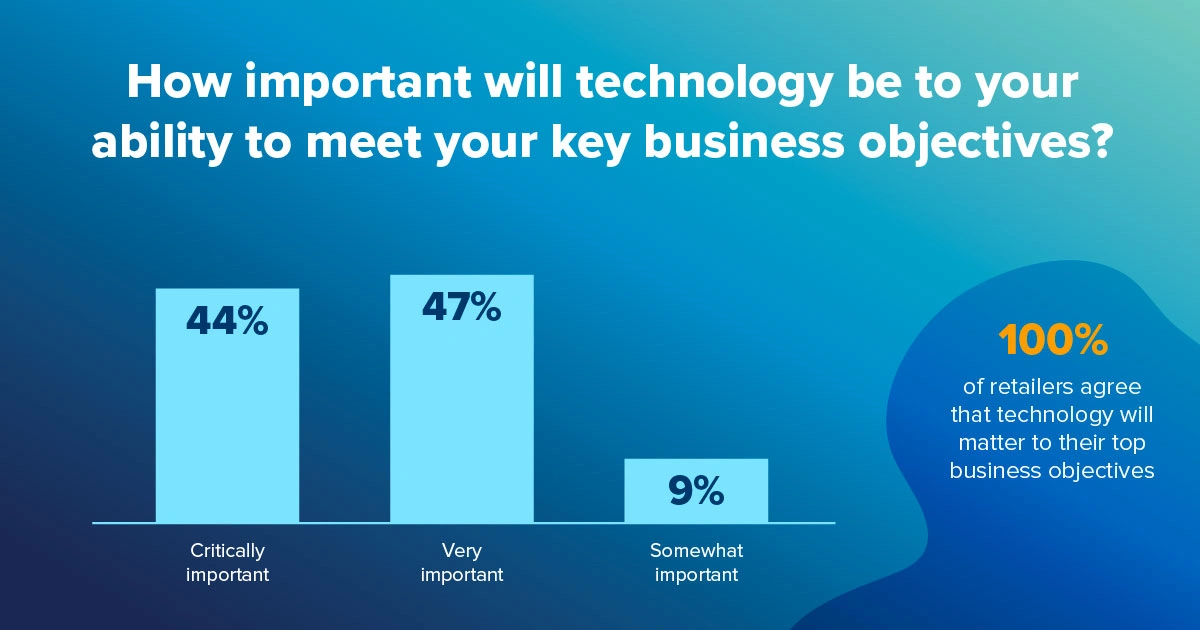

100% of respondents indicated that technology would be at least “somewhat important” to achieving diverse business goals, including cost controls, new revenue channels and modernizing their stores to compete in an increasingly omnichannel industry. Most retailers surveyed are only somewhat satisfied with their current technology suite, which is why nearly all respondents expressed some level of intent to invest over the next 12 months.

Why we think you should add to your cart

We agree that now is an optimal time for grocers to explore the transformative power of the right technology. In order to successfully navigate the new retail landscape, grocers are realizing that they must ramp up and move forward with investments in technology. Consumers have evolved and are utilizing technology to help look for discounts to offset the rise in prices of items they purchase every day.

Grocers are also realizing that manufacturers are focused on supply chain optimization and the use of technology to help them with their Revenue Growth Management journey. As the sell-in vendor business has embraced technology and sell-out consumer volume has followed the same path, grocers don’t want to be left behind.

Key Finding 2: It addresses immediate challenges

Grocers have broadly reached a consensus that technology will play a major role in addressing immediate challenges and preparing the supermarket industry for the future. They are ready to invest, but they still intend to act cautiously to protect profitability and grow their IT infrastructure in a way that scales with their business and strengthens their relationships with customers.

Why we think you should add to your cart

Grocers are acting cautiously as they try to understand where the best place is to invest. The consumer is driving business, but the technology needed to understand shopper behavior is relatively new, and it encompasses not only the analysis of traditional merchandise conditions but additional data points from social media, web data scraping, search engine tracking and web page positioning. However, on the sell-in volume technology side, grocers are actually finding this investment has more proven concepts with a sound ROI.

Both sides of the technology coin will require a significant capital investment and a business case that would contain a risk factor and recoup on investment. Additional complexity and consideration come into play when you choose to invest in technology; you can’t ignore one side of the volume flow equation. The optimal technology mix should provide the ability to:

- manage complex overlapping vendor incentive contracts

- automatically validate that you’re receiving the agreed-upon incentive condition

- deliver price management and analytics for list pricing, everyday pricing, promoted price frequency and depth with demand elasticity modeling

- exist in a single application and require minimal implementation and connection to the price execution systems

Key Finding 3: It’s about reducing costs with efficiency

When asked to rank a handful of potential priorities 1 through 5, retailers were most likely to name operational efficiency as their top choice. Operational efficiency encompassed several parts of the profitability equation for respondents, including ways to reduce costs and automate manual processes. Retailers appear to see a business case for efficiency software more readily. These priorities still bring some concerns, such as “lack of integration”, potential disruption to operations if they were to implement new systems, and potential difficulties scaling new systems as they grow.

Why we think you should add to your cart

These are very valid points. Operational efficiency is often overlooked when searching for ways to reduce costs. Lack of integration is also a primary concern for retailers in general. They’ve approached technology in the past with niche-filling, purpose-built software to manage a single process. However, this has resulted in multiple systems that are on different architectural platforms, making it difficult to connect them, even with a real-time API.

Change and disruption are very similar in nature, and this has to be considered when creating a project scope for implementing a new system. Ultimately, grocery retailers have to consider growth by expansion and acquisition to ensure that any software investment will scale to a 5-7 year plan.

Want to learn more about retail revenue management by using automation to control costs and drive demand?

Get the latest news, updates, and exclusive insights from Vistex delivered straight to your inbox. Don’t miss out—opt in now and be the first to know!