Market analysis: the beauty industry in transition

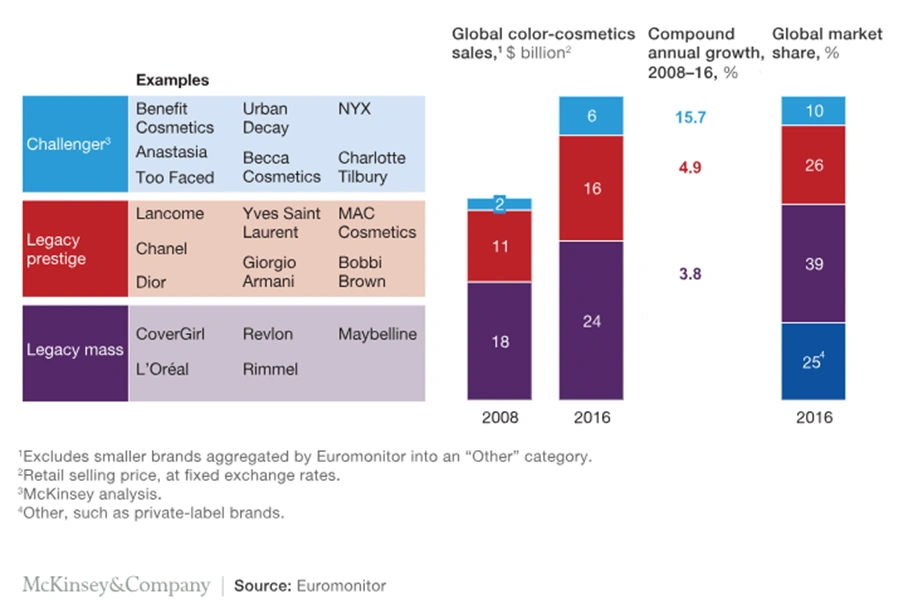

The global cosmetics and personal care market is growing. According to Euromonitor, it is currently worth 250 billion US dollars. But the beauty industry is changing: So far, both the majority of the market shares and the prestige have been with large cosmetics manufacturers and brands such as L'Oréal, Dior and Chanel . Most recently, however, it was mainly young beauty companies (such as Too Faced or Benefit Cosmetics ) that conquered the market. Between 2008 and 2016, these “challengers” grew by 15.7 percent annually, four times as fast as established cosmetic giants. They gained a market share of 10 percent.

As the figures from Euromonitor show, since 2008 young cosmetics companies have grown around four times as fast as established industry giants. (Source: McKinsey & Company.)

One of the reasons for the success of the young brands is their digital expertise. In most cases, they started as a purely online company and quickly reached a broad target group via social media. But the alarm bells are now ringing among established beauty players. They are expanding their multichannel strategies and opening up to sales on marketplaces. And online retailers also want a piece of the cake and are increasingly entering the cosmetics market.

For a long time a latecomer in e-commerce, the online cosmetics trade is now a booming sector. If you want to play a role in the market, you have to look for shares now. In today's article, we are therefore giving you an overview of current market developments and digital strategies in the online beauty industry.

Cosmetics industry pioneer in the field of digitization

Overall, when it comes to digitization, cosmetics companies are pioneers in the field of fast-moving consumer goods (fast-moving consumer-goods / FMCG). While the FMCG industry grew by just 2.5 percent a year between 2012 and 2016, the decorative cosmetics business grew by an average of 5 percent a year. The reason for these differences: Digital technologies have revolutionized buying and consumer behavior and require new marketing strategies. Many FMCG players are struggling to keep up with the changes. But the cosmetics industry as a whole has understood how to use the developments for itself. Consumers are tied to the brand via social media, influencers create new trends with their posts, stories and appearances and consumers receive information about the products, make-up tips and instructions in cosmetic videos. These are the results of the study "What beauty players can teach the consumer sector about digital disruption ”from management consultancy McKinsey & Company.

“Cosmetics customers discovered new technologies such as social media earlier than in other segments in order to obtain information and to buy beauty products. With their strong visual nature and emotional bond, decorative cosmetics are almost ideal for taking on the pioneering role in the wave of digitization, ”says Stefan Rickert, McKinsey partner and consumer goods expert.

Established companies learn from digital attackers

With the advance of beauty startups and their successful digital strategies, the established beauty companies are also starting to rethink: They are buying up these young providers, restructuring them internally, or are increasingly relying on online trading.

Douglas last caused a bang in June 2018: The European market leader in the beauty segment acquired the majority of the stationary perfumery chain Akzente and its successful online shop parfumdreams. Douglas plans to be the most important beauty destination online too. In an interview with Horizont, CMO Lucas van Eeghen says: "In the beauty trade, the future belongs to those who offer customers unique shopping experiences."

In addition to the specialist Douglas, major retailers brought movement to the beauty industry last year. So did the two heavyweights Otto and Zalando. Otto has been selling around 1,000 products from the cosmetics manufacturer L'Oréal since the end of 2017 and another 500 products could be added within this year. The exciting thing is that the cosmetics manufacturers are said to have initiated the collaboration themselves. No wonder, because L'Oréal has been successfully using online marketing for years.

In March 2018, Zalando also entered the beauty industry. Since then, over 4,000 beauty products for women have been available on Zalando.de. But the retailer is not limited to online sales: In June, Zalando opens the “Beauty Station” in Berlin - a stationary concept store where customers can experience the Zalando world of beauty live and receive valuable tips from beauty experts.

Direct sales model brand Avon could no longer avoid the pressure of digitization: The US cosmetics manufacturer launched an online shop in Germany at the beginning of October.

Stationary retail continues to convince consumers

Despite the e-commerce boom, a study by the Berlin market research company POSpulse showed that stationary retail continues to be convincing. As part of the study, almost 1,000 consumers (61 percent male, 39 percent female) were asked about their purchasing behavior for cosmetics and beauty products. The results show that almost no one buys these exclusively online. 62 percent still prefer stationary retail and 35 percent buy partly online and partly offline. But the arguments in favor of buying online are convincing: According to the respondents, the shops score above all with a large selection of products (76 percent), shopping options around the clock (70 percent) and convenient delivery directly to your home (69 percent) ). The reasons for buying offline are the immediate availability (48 percent), test options (25 percent) and the wide range of products (19 percent). For the future in the beauty industry, the market research company sees an increasing interdependence between online and offline channels and recommends implementing targeted marketing measures both digitally and stationary.

Consumers still prefer to buy cosmetics and beauty products offline (62 percent). But at least 35 percent buy their care products and make-up both online and in-store.

The most important weapon in the beauty competition: active price management

The market for beauty and cosmetic products is a challenging industry with intense competition. A precise market overview is all the more important for your own company's success. Because only those who know the offers and pricing strategies of the competition can make better decisions about their own prices and product ranges. As our report makes clear, the majority of German online beauty retailers still have some catching up to do. So far, only a quarter of the online shops examined have implemented strategic price management. In order to remain competitive in the long term in the highly competitive e-commerce market, systematic pricing is essential.

Always have an eye on the online market for beauty and cosmetic products. The unique matching technology and the excellent data quality from our solution gives you clear competitive advantages in e-commerce.

Get the latest news, updates, and exclusive insights from Vistex delivered straight to your inbox. Don’t miss out—opt in now and be the first to know!