How do OEMs Monetize the Electric and Software-Defined Future?

Gone are the days when superior engineering and horsepower ruled. Today, vehicles are becoming more about code, connectivity, and continuous upgrades. As electric vehicle (EV) adoption rises and cars evolve into software-defined platforms, automakers must contend with unprecedented complexity—not just in hardware, but also in revenue models, aftersales revenue disruption, competitive pressure, pricing and regional compliance.

Cold as ICE: The new direction for how OEMs monetize their value

Many global OEMs have already announced timelines to phase out internal combustion engine (ICE) production entirely over the next decade, marking the end of an era where mechanical quality and performance reigned supreme.

Electrification, autonomy and digitalization are now the core forces reshaping how value is created in the industry. Over the next decade, software architecture will replace mechanical engineering, with code, not combustion, driving innovation.

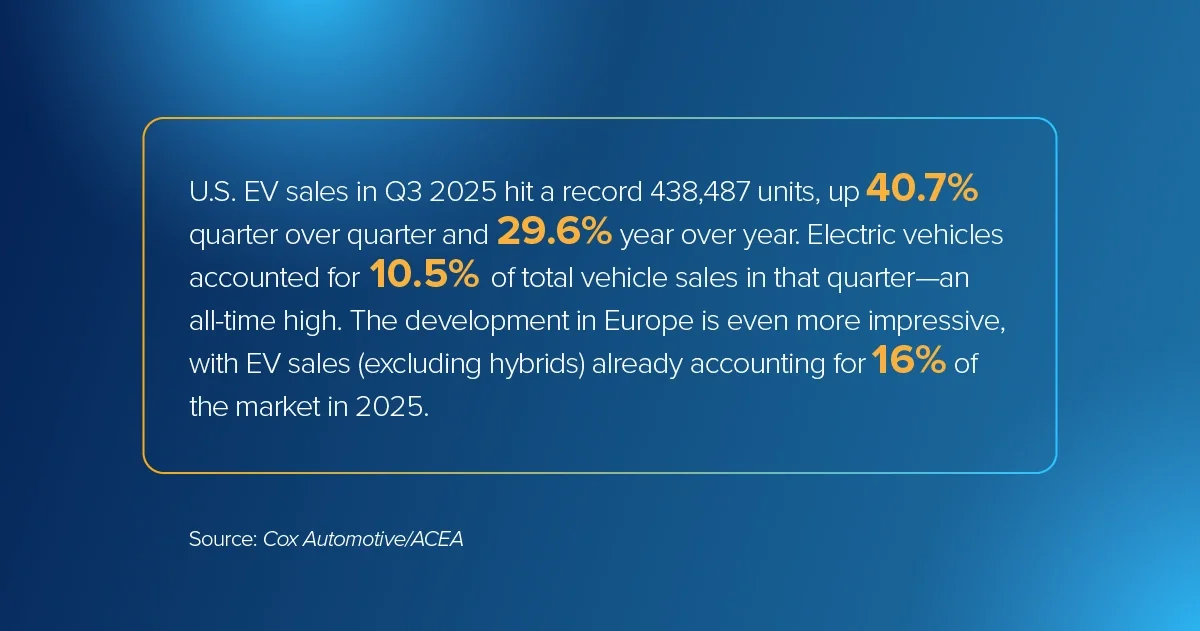

As this transition accelerates, the market itself is offering unmistakable proof. Consumer adoption of EVs have begun to scale at a pace that would have been unthinkable just a few years ago, signaling that the shift from mechanical to software-centric value creation is already well underway.

These figures highlight both pent-up demand and the growing normalization of EVs in the mainstream. They also underscore what’s at stake: automakers must now manage the decline of ICE portfolios while scaling new, software-centric revenue models.

What lies beneath: The subsurface revenue streams OEMs overlook

Traditional profit models, long anchored in volume sales and aftermarket services, are giving way to an era where software, data and digital services will fuel consistent revenue streams. EVs have far fewer wear-and-tear parts than ICEs and require less frequent service, leading to a projected drop of around 60% in parts and service revenue for OEMs and dealers alike.

At the same time, pricing and incentive strategies are becoming increasingly complex. Automakers must balance declining ICE inventory, fluctuating battery costs, evolving regional regulations and real-time software updates that add features or performance boosts after the sale.

The traditional one-time transaction model no longer fits. Instead, auto manufacturers’ success depends on managing subscription-driven features, dynamic pricing and incentive layers while ensuring each new revenue opportunity enhances brand value and customer trust. If you have end-to-end visibility into pricing, incentives and revenue management, you will be equipped to adapt strategies in real time and link every decision to margin performance.

Breaking the ice: Remove barriers for effective monetization

Even as EV and software-defined vehicle (SDV) adoption accelerates, automakers face challenges that extend beyond engineering. The transition from ICE to intelligent, connected platforms requires rebuilding business models, rethinking incentive structures and redefining value across the supply chain.

Legacy systems and fragmented data are often the most significant obstacles. Many manufacturers still rely on disconnected platforms that can’t keep pace with the dynamic pricing, regulatory variation and over-the-air (OTA) update models shaping today’s market. Add in global cost pressures and the sunset of ICE-based revenue streams, and the path forward becomes even more complex.

To “break the ice,” OEMs must bridge the gap between physical production and digital performance. That means integrating revenue, pricing, and incentive management within a single intelligent framework that unites financial and operational decisions in real time. With centralized control and localized flexibility, OEMs won’t melt under the pressure to align global programs with regional requirements, adjust to market demand, and monetize every vehicle feature throughout its lifecycle. From the assembly line to the cloud, manufacturers will be empowered to navigate the post-ICE era with precision, agility and profitability.

Learn more about automotive best practices for pricing, rebate and incentives.

Get the latest news, updates, and exclusive insights from Vistex delivered straight to your inbox. Don’t miss out—opt in now and be the first to know!