Why Year-End Trade Spend Reconciliation Matters for CPG Manufacturers

Year-end trade spend reconciliation is a critical and challenging process for CPG manufacturers. As Q4 promotional activity peaks, Finance teams must accurately calculate outstanding retailer liabilities, align trade accruals with actual promotional spend, and identify budget variances before closing the books. Getting this right ensure accounting compliance and helps teams start 2026 with accurate baselines to protect margins and ensure trade spend strategy is built on accurate data.

How to Close the Books Fast in CPG Trade Spend Management Without Losing Accuracy

As CPG manufacturers approach 2025 year-end close, they face the dual pressures of speed and precision. Year-end trade reconciliation is uniquely complex because promotional activity intensifies in Q4, increasing the volume of deductions, claims, and adjustments flowing into Finance. When late-year promotion spend liabilities remain unresolved, like unpaid or disputed retailer deductions, Finance and Sales often struggle to align on the actual numbers. This misalignment erodes trust, slows close cycles, and forces teams into reactive firefighting when discrepancies emerge. More importantly, outstanding liabilities and accrual misalignment spill directly into next year’s planning, skewing budgets before 2026 even begins. Without accurate inputs at close, companies start the next fiscal year with distorted baselines, unclear spending capacity, and misinformed trade strategies.

How to Calculate CPG Trade Spend Liability and Know Exactly What is Owed to Retailers

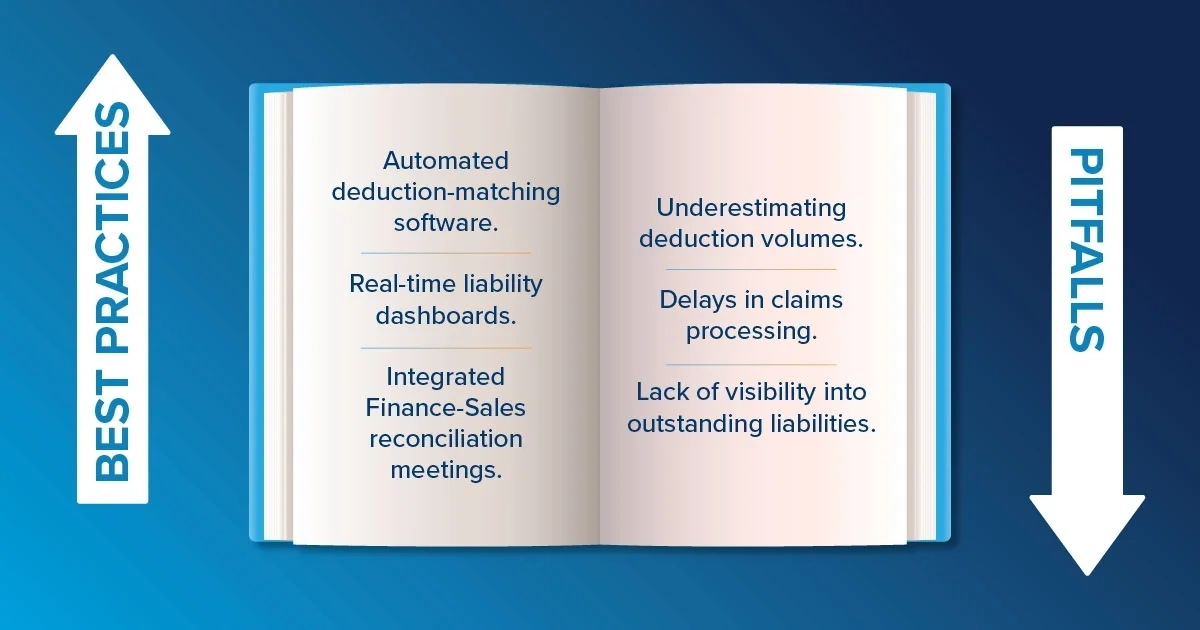

The first step in establishing that baseline is accurately quantifying what you still owe retailers for promotions, particularly November and December events that haven’t yet cleared through deduction or claims workflows. Many CPGs struggle because they routinely underestimate deduction volumes during peak promotional periods, and delays in retailer settlement further obscure the picture. These pitfalls often lead to understated liabilities, leaving Finance unprepared for the wave of deductions that arrive in January and February.

To streamline trade spend reconciliation, leading organizations now rely on purpose-built tools and best practices: automated deduction matching and validation, predictive liability modeling, visibility dashboards, retailer scorecards, and tighter reconciliation cadences across Finance, Sales, and Customer teams. These capabilities reduce blind spots, improve forecast accuracy, and give leadership a clear, real-time view of outstanding financial exposure before closing the books.

Ways to Align Trade Accruals with Actual Promotional Activity Instead of Historical Averages

Once liabilities are visible, the next critical step is to ensure accruals accurately reflect actual promotional activity, not legacy estimates or historical averages. Many teams still use percentage-based methods that fail to capture promotion-level detail, resulting in over-accruals that artificially depress available spend or under-accruals that mask absolute liability until it hits the profit and loss statement (P&L). Both scenarios distort margin visibility and damage forecasting accuracy.

Effective trade spend reconciliation requires Finance, Sales, and revenue growth management (RGM) must adopt more collaborative, real-time processes: shared reporting, integrated planning tools, cross-functional accrual review meetings, and synchronized calendars that tie accruals to actual retailer commitments. This alignment not only strengthens the P&L but also improves transparency and reduces the end-of-year tension that arises when teams are forced to reconcile mismatched assumptions or outstanding liabilities.

What to do if You’re Over or Under-Spent in Trade Promotions and How it Impacts 2026 Planning

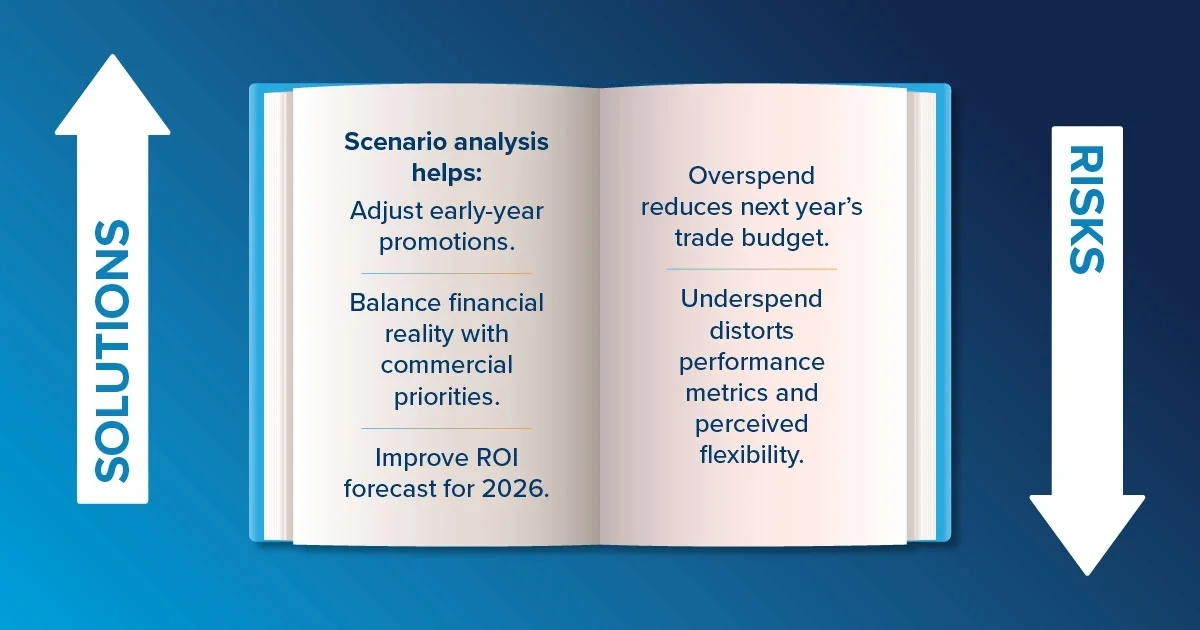

Identifying whether the organization ended the year over- or under-spent is essential for building an accurate 2026 plan. Overspending late in the year, especially when coupled with under-accruing, acts as a “tax” on the upcoming year’s trade budget, reducing the funds available for early promotions and putting immediate pressure on brand teams. In contrast, underspending can create a false sense of financial flexibility. Teams may misinterpret leftover dollars as efficiency or unneeded investment, when the underspend might reflect canceled promotions, retailer pullbacks, or execution gaps that distort performance metrics.

To address this, companies should use scenario analysis to revise early-year promotional plans, adjusting tactics, spend levels, and expected ROI based on year-end variances. This ensures that 2026 launches not with guesswork, but with a balanced, reality-based plan.

Turning Year-End Accounting Precision into a CPG Trade Spend Strategy Advantage for 2026

When executed thoroughly, year-end reconciliation becomes a strategic capability, not just an accounting requirement. Accurate liability assessments, well-calibrated accruals, and a disciplined approach to variance enable leaders to enter 2026 with clarity and confidence rather than liabilities from 2025.

Increasingly, companies are leveraging analytics and AI to turn year-end data into deeper insights: detecting spend leakage, predicting retailer deduction patterns, and improving accrual accuracy for the year end close. With this foundation, manufacturers can convert accounting precision into a forward-looking planning advantage, enabling smarter promotional execution, better margin protection, and more profitable revenue growth. The organizations that get this right don’t just close their books—they set themselves up to outperform.

Leave Year-End Chaos Behind.

The CPG manufacturers that excel at year-end trade spend reconciliation don’t just meet their close deadlines; they use the process to build a stronger foundation for the year ahead. By accurately quantifying liabilities, aligning accruals with actual promotional activity and analyzing spend variances, you transform accounting rigor into strategic intelligence. This clarity enables you to launch 2026 confidently with sound promotional plans, optimized retailer investments, and protected margins.

Get the latest news, updates, and exclusive insights from Vistex delivered straight to your inbox. Don’t miss out—opt in now and be the first to know!