Chips And The Dip - The Semiconductor Industry and Supply Chain Challenges

On May 13th, Vistex presented its inaugural High Tech Virtual Industry Summit—and what an amazing event it was. We kicked off the day with an insightful keynote address: “Short Circuit—The Global Semiconductor Industry and Supply Chain Challenges,” presented by leading industry analyst Malcolm Penn, Chairman and CEO of Future Horizons. Here’s a small taste of the knowledge nuggets he shared.

The global semiconductor catastrophe no one saw coming

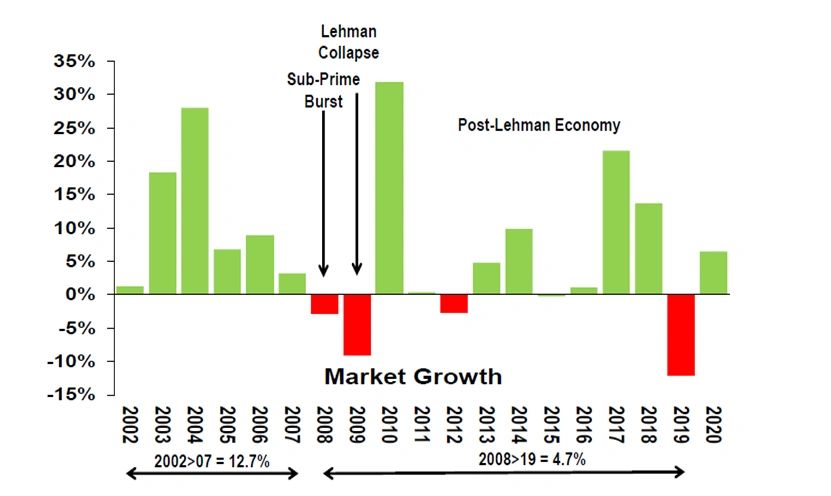

The semiconductor industry is in the midst of a massive disruption, the likes of which we have not seen for a while. Before the financial crisis of 2008-2009 the market was undergoing double-digit growth (12.7% YOY). But in the decade since the crash, it has experienced low-single-digit growth (4.7%). With the decrease in demand, the industry came to the (incorrect!) conclusion that the semiconductor market had matured, and demand would never return to its previous levels. The industry had adjusted to this supposedly new level of demand. Everyone was asleep at the wheel. Everything was running smoothly. The supply chain was balanced—but at a very low level of demand. The COVID-19 pandemic woke everyone up by quickly upended the status quo.

What could possibly go wrong?

Just a small uptick in demand quickly sent the semiconductor supply chain into a whirlwind from which it will take months or years to recover. Lead times for new capacity are very long compared with cycle times for demand, which can be exceptionally short. It takes 12-18 months to install new capacity—and that’s assuming you already have a suitable facility capable of the required production. Low levels of inventory and just-in-time manufacturing simply don’t work in semiconductors.

The perfect storm of undersupply and overdemand was already brewing; the pandemic was just the tipping point. Supply maxed out in Q4 2020 because the industry failed to invest in Q4 2019. That was before the COVID impact, so you can’t blame the entirety of the problems on the pandemic.

The world comes to a grinding halt

A recently published article in The New York Times described “chips as being the new toilet paper.” While they’re not something consumers think about every day, they are both essential to everyday life. We all depend on microchips to power our devices such as cars, TVs, mobile phones and gaming consoles. But there are so many more uses for chips such as:

- refrigerated trucks

- automatic doors

- bar code readers

- fitness and medical wearable devices

- voice activated devices

Semiconductors really are at the heart of everything we do. Without them the world comes to a grinding halt. Today’s shortage is igniting a power struggle between manufacturers and their customers about how the industry’s supply chain will work and who pays the cost of carrying inventory. The shift from the current system, where chipmakers hold excess inventory to accommodate the usual just-in-time supply chain is no longer sustainable. Simply put, customers will need to hold more inventory or agree to non-cancellable contracts to create a more predictable supply chain and reduce the risk of shortages.

The M&A buffet often leads to indigestion

The dizzying level of M&As (with further consolidation expected) has created yet more challenges for the High Tech industry. The ideology behind M&As is that the sum of the parts is greater than the value of the individual pieces. Yet poor planning and execution doom many M&As and prevent them from reaching their full potential:

Ideal M&A Target Attribute Wish List

- outstanding engineering

- great product knowledge

- fills a technology gap or gets products to market quicker

- easily fits into existing organizational infrastructure

- raises the average company IQ

M&A Reality (PWC) “majority of acquisitions destroy shareholder value” Causes include:

- management ego and delusion

- no clear acquisition strategy

- poorly integrated execution

What goes around comes around. Don’t end up in tears.

Interested in hearing more from Malcolm’s keynote address? Catch the replay on demand.

Get the latest news, updates, and exclusive insights from Vistex delivered straight to your inbox. Don’t miss out—opt in now and be the first to know!