How wholesale contract pricing compliance automation saves margins

Every month, your wholesale distribution business processes thousands of transactions. Every month, hundreds of them are wrong. And every month, those errors cost you a fortune you don’t realize you’re losing.

While you’re focused on supply chain challenges and competitor moves, the real threat to your profitability is hiding in plain sight: Pricing errors that systematically bleed profit from every corner of your operation.

In this business, pricing errors are a hidden drain on profitability. These mistakes often go unnoticed, buried in deductions or margin reports. In my opinion, the real issue isn’t upstream challenges; it’s internal inefficiency creating recurring errors that erode trust and margin.

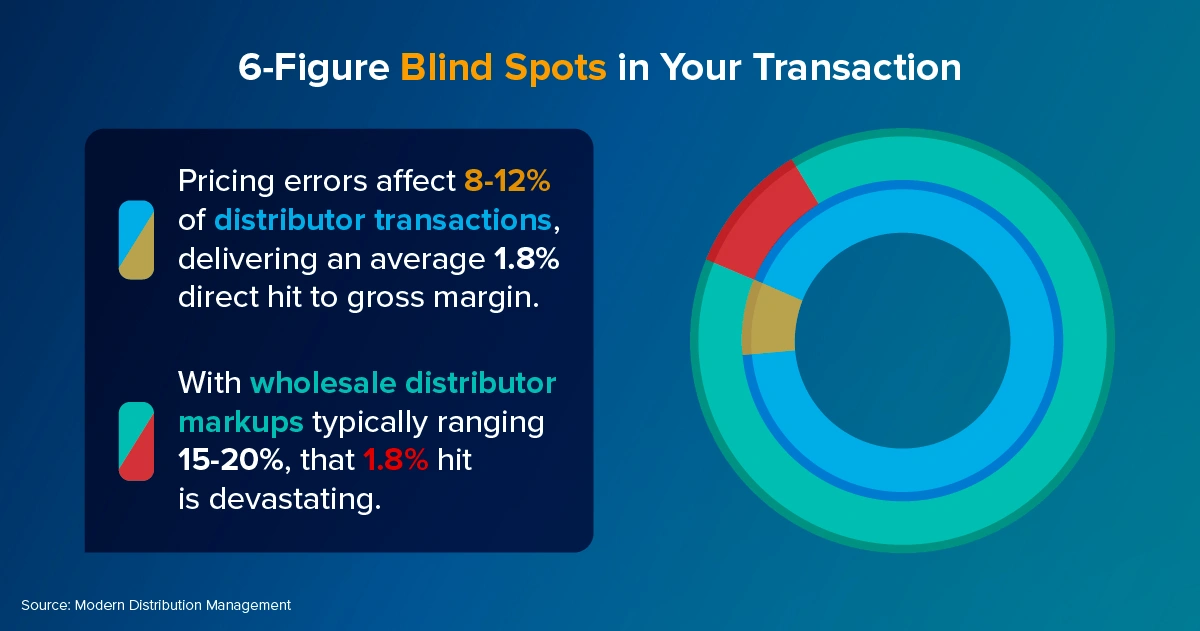

6-figure blind spots in your transaction data

Pricing errors affect 8-12% of distributor transactions, delivering an average 1.8% direct hit to gross margin. With wholesale distributor markups typically ranging 15-20%, that 1.8% hit is devastating.

Source: Modern Distribution Management

When pricing errors deliver that 1.8% margin hit, nearly one-tenth of your gross profit disappears due to preventable mistakes. That capital could go towards digital innovation or sales acceleration, but it’s lost to manual errors.

Instead of appearing as red flags on your P&L, these margin leaks hide in deduction write-offs, billing disputes and customer churn.

Are you tracking these errors as a separate performance metric?

The hidden costs of manual pricing

Beyond the noticeable margin impact, manual contract pricing creates unaccounted costs:

- Sales team distraction

Sales reps spend hours on price verification instead of selling - Credit impact

Disputed invoices slow cash flow - Reputational damage

Repeated errors erode customer trust - Shadow systems

Excel trackers consume time and create audit risks - Missed revenue

Outdated or misapplied escalators and index-linked terms erode profits

When complexity becomes your foe

You navigate unprecedented pricing complexity, including customer-specific agreements, volume tiers, promotional schedules, rebate structures and seasonal rules. Your teams manually cross-reference spreadsheets under pressure, introducing risk with every process.

B2B buyers expect Amazon-like precision: instant quotes, frictionless transactions and seamless contract compliance. Manual workflows can’t deliver. Regulatory oversight intensifies with pricing discrimination regulations and audit requirements that spreadsheet tracking can’t meet.

Every new customer agreement increases complexity. Without automation, complexity scales costs, not value. It’s a formula for eroded margin and team burnout.

External forces accelerate urgency

Several market forces make pricing automation critical, including:

- Persistent inflation

Costs change faster than outdated systems can keep up - Volatile supply chains

Real-time adjustments are essential during allocation shifts - Labor shortages

Lean teams can’t keep up with manual validation - AI adoption

Competitors are using pricing algorithms for margin advantage

- Regulatory scrutiny

Antitrust and fair pricing audits are increasing

The smart money move

Contract pricing compliance automation transforms reactive loss management into proactive margin defense. McKinsey reports that business AI adoption rose 22% from 2023 to 2024.

Modern contract pricing solutions consolidate agreements into a single source of truth with automated workflows, version control and real-time auditing. These platforms correct mistakes and unlock competitive advantage by analyzing pricing history and flagging high-risk scenarios before they are invoiced.

The best pricing systems flag errors and learn from them. Intelligent platforms predict where issues are likely and prevent them before impacting the bottom line.

Precision: Power for your future

I believe the real power of pricing automation lies in precision. More than a competitive advantage, precision is insurance for future business and your company’s reputation.

You gain real-time visibility into contract utilization, margin performance and pricing accuracy. These insights enable refined pricing models, smarter negotiations and targeted improvements. As complexity compounds with growth, automation scales, turning potential liabilities into operational assets.

Would your team be confident in their documentation and compliance history if your biggest customer audited your pricing tomorrow?

Unlock advanced pricing models

Traditional cost-plus models fall short in competitive categories. Pricing automation unlocks dynamic and value-based pricing by centralizing data and enabling real-time adjustments. You can build pricing structures based on customer lifecycles, value or market triggers, which is difficult to track manually.

4 steps to profit protection

Successful transformation demands a structured approach:

- Audit first

Examine current agreements and identify failure points - Engage stakeholders

Involve sales, finance and operations teams early. Align sales and pricing teams on metrics and accountability - Standardize workflows

Optimize pricing governance before digitizing. Focus on clean data inputs to avoid “garbage in/garbage out” - Establish feedback loops

Use system data for continuous improvement

Measuring success: Essential KPIs

You should monitor these metrics after implementation:

- Pricing accuracy rate (pre- and post-automation)

- Invoice to contract match rate

- Margin recovery per transaction

- Quote to order cycle time

- Manual pricing override rate

- Sales time spent on price inquiries versus selling

ROI reality: Beyond error correction

Returns extend beyond immediate margin protection. Distributors see improved contract accuracy, sales efficiency, quote turnaround and customer retention.

It’s about fueling growth, not just plugging leaks. Automation shifts focus from firefighting to strategy.

What’s the opportunity cost of not automating? It’s not just about today’s errors. It’s about deals you could be pricing smarter, faster and more profitably

Strategic transformation insights

Manual pricing is no longer sustainable. Automation is a margin enabler, not just a compliance tool. In my opinion, there are 3 critical mindset shifts for success:

- Treat pricing as strategic, not just financial. Price is one of the last controllable levers to protect margin at scale.

- Automation elevates pricing roles. Your team shifts from data entry to price optimization and scenario modeling.

- Start small, but start now. Choose one segment, prove value, then expand.

Lead or lose ground

Remember those thousands of monthly transactions? They’re costing you money you’ll never recover. Your competitors are implementing systems that turn transaction volumes into competitive advantage.

The bleeding stops when you decide it stops. Every month you delay, more transactions slip through with preventable pricing errors.

From my perspective, contract pricing automation isn’t a back-office upgrade; it’s a growth enabler that protects your present and positions you to scale accurately, quickly and confidently.

The technology exists and the ROI is proven. Your choice is to keep writing checks for mistakes that shouldn’t happen, or plug the leaks draining your profits.

Read our blog for more information on wholesale distribution pricing.

Gain valuable insights on the importance of pricing for your wholesale distribution business.

Get the latest news, updates, and exclusive insights from Vistex delivered straight to your inbox. Don’t miss out—opt in now and be the first to know!